Beef Checkoff Compliance

Paying Your Checkoff

By law, all producers selling cattle or calves, for any reason and regardless of age or sex, must pay $1-per-head to support beef/veal promotion, research and information through the Beef Promotion and Research Act. Here are some specifics:

- Whoever makes payment to the seller is considered a "Collection Point" or person and must withhold $1-per-head, remitting those funds to the Qualified State Beef Council (QSBC) where they live. Collection points could include auction markets, feedyards, dealers/order buyers, other producers, auctioneers, clerking services, banks, packers and other entities.

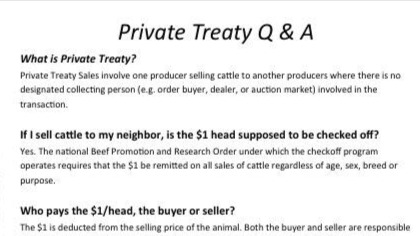

- The buyer is generally responsible for collecting $1 per head from the seller. By law, both buyer and seller are equally liable to see that $1-per-head has been collected and paid.

- Also under the Act and the Order, the State Beef Council is legally responsible for collecting monthly assessments as well as a two percent late charge on checkoff remittances if they are not received in our office postmarked by the 15th of the month following the month of sale.

- No producer is exempt from the checkoff. Buyers who resell cattle no more than 10 days from the date of purchase may file a non-producer status form and avoid paying an additional dollar. They are, however, responsible for remitting collected funds and reporting any transaction to the QSBC.

- Remember: A dollar or a document! All selling/purchase transactions must be reported. In each case, either $1-per-head or non-producer status form document must be collected by the buyer from the seller to show the dollar has been collected and paid within the past 10 days.

- If it's more convenient, the seller of cattle may collect and remit funds collected. For instance, purebred breeders selling to many different buyers may wish to remit the checkoff themselves; persons exporting cattle should also pay when the cattle change hands. Buyers should keep receipts showing the checkoff has been paid.

- Persons in non-compliance with the Act and Order are subject to a civil penalty of up to $7,500 per transaction, plus unremitted checkoff dollars and interest.

Research shows the checkoff returns more than $11 to the industry for every dollar invested.

Instructions for Completing the Monthly Checkoff Remittance Form

Learn More

The completed form should be sent along with payment to:

INDIANA BEEF COUNCIL

PO BOX 3316

INDIANAPOLIS, IN 46206-3316

Learn more about the Beef Checkoff Program